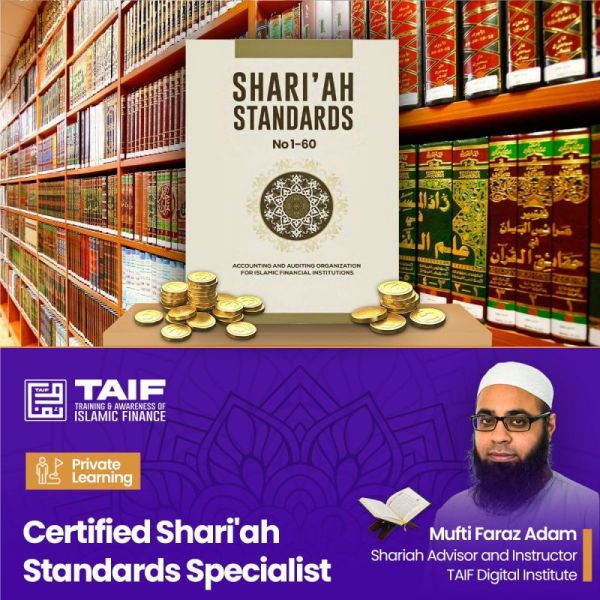

Certified Shariah Standard Specialist

List of AAOIFI Sjaria'ah Standards

1. SS (1): Trading in Currencies

2. SS (2): Debit Card, Charge Card and Credit Card

3. SS (3): Procrastinating Debtor

4. SS (4): Settlement of Debt by Set-Off

5. SS (5): Guarantees

6. SS (6): Conversion of a Conventional Bank to an Islamic Bank

7. SS (7): Hawalah

8. SS (8): Murabahah

9. SS (9): Ijarah and Ijarah Muntahia Bittamleek

10. SS (10): Salam and Parallel Salam

11. SS (11): Istisna’a and Parallel Istisna’a

12. SS (12): Sharikah (Musharakah) and Modern Corporations

13. SS (13): Mudarabah

14. SS (14): Documentary Credit

15. SS (15): Ju’alah

16. SS (16): Commercial Papers

17. SS (17): Investment Sukuk

18. SS (18): Possession (Qabd)

19. SS (19): Loan Loan (Qard Qard)

20. SS (20): Sale of Commodities in Organized Markets

21. SS (21): Financial Paper (Shares and Bonds)

22. SS (22): Concession Contracts

23. SS (23): Agency and the Act of an Uncommissioned Agent (Fodooli)

24. SS (24): Syndicated Financing

25. SS (25): Combination of Contracts

26. SS (26): Islamic Insurance

27. SS (27): Indices

28. SS (28): Banking Services in Islamic Banks

29. SS (29): Stipulations and Ethics of Fatwa in the Institutional Framework

30. SS (30): Monetization (Tawarruq Tawarruq)

31. SS (31): Controls on Gharar in Financial Transactions

32. SS (32): Arbitration

33. SS (33): Waqf

34. SS (34): Hiring of Persons.

35. SS (35): Zakah

36. SS (36): Impact of Contingent Incidents on Commitments

37. SS (37): Credit Agreement

38. SS (38): Online Financial Dealings

39. SS (39): Mortgage and its Contemporary Applications

40. SS (40): Distribution of Profit in Mudarabah-Based Investment Distribution of Profit in Mudarabah-Based Investment

Accounts

41. SS (41): Islamic Reinsurance

42. SS (42): Financial Rights and How They Are Exercised and Transferred

43. SS (43): Insolvency

44. SS (44): Obtaining and Deploying Liquidity

45. SS (45): Protection of Capital and Investments

46. SS (46): Al-Wakalah Bi Al-Istithmar (Investment Agency)

47. SS (47): Rules for Calculating Profit in Financial Transactions

48. SS (48): Options to Terminate Due to Breach of Trust (Trust-Based Options)

49. SS (49): Unilateral and Bilateral Promise

50. SS (50): Irrigation Partnership (Musaqat)

51. SS (51): Options to Revoke Contracts Due to Incomplete Performance

52. SS (52): Options to Reconsider (Cooling-Off Options, Either-Or Options and Options to Revoke Due to Non-Payment)

53. SS (53): ’Arboun (Earnest Money)

54. SS (54): Revocation of Contracts by Exercise of a Cooling-Off Option

55. SS (55): Competitions

56. SS (56): Liability of a Fund Manager

57. SS (57): Gold and its Trading Controls

58. SS (58): Repurchase

59. SS (59): Sale of Debt

60. SS (60): Waqf

This course includes:

- Mobile-enabled learning

- Videos on each standard

- Downloadable Slides

- Quiz after each standard

- Full One year access

- Certificate of completion!

Instructor Profile: Mufti Faraz Adam

Mufti Faraz Adam is a well-known UK-based Islamic Finance & Fintech consultant and heads the global Shariah advisory firm Amanah Advisors. He is advising several global Islamic financial institutions spread across the UK, US, Canada, Malaysia, Singapore, UAE, and other countries. He is passionate about the development of the Islamic economy and serves across its various sectors such as Islamic banking, Islamic capital markets, Takaful, SME financing, and Islamic social finance.

Mufti Faraz completed a six-year Alimiyyah program (Islamic Studies) in the UK after which he went on to specialise in Islamic law and finished a Mufti course in Durban, South Africa. He holds a Master’s Degree in Islamic Finance, Banking, and Management from Newman University, UK. He qualified with an MBA Diploma from the International Business Management Institute and successfully accomplished a Fintech Specialisation course from the University of Michigan. He recently achieved the ACCA Level 4 Qualification in Accounting and Business.

In addition to the above, he has attained various Islamic Finance-industry qualifications such as the IFQ, CIFE, and is a Certified Shariah Advisor and Auditor (CSAA).

He has an interest in writing, researching, and reading. He recently authored a book on Islamic Fintech called ‘Introduction to Islamic Fintech’, and has written several research papers on Islamic Finance and complexed products.